Financial Solutions

Financial planning and analysis (FP&A) are a set of planning, forecasting, budgeting, and analytical activities supporting a company’s major business decisions and overall financial health. With a corporate FP&A system, finance teams can combine financial data, operational data, and external data (like market trends) in one place. Finance analyzes to uncover the in-depth insights needed to plan and guide more profitable decision-making.

FP&A Tools Can Help Finance Professionals

Basic Steps In The FP&A Process

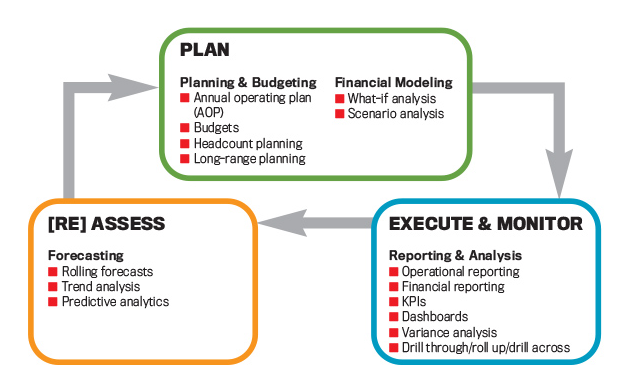

The FP&A process is a continuous cycle of data collection and analysis. As businesses grow and expand into new markets, during times of market volatility and rapid change, the process becomes more complex. More data needs to be collected and more analysis needs to be done. Hence, many large and midsize companies have formed dedicated FP&A branches within their finance departments.

The FP&A process includes four basic steps:

1. Data collection, consolidation and verification

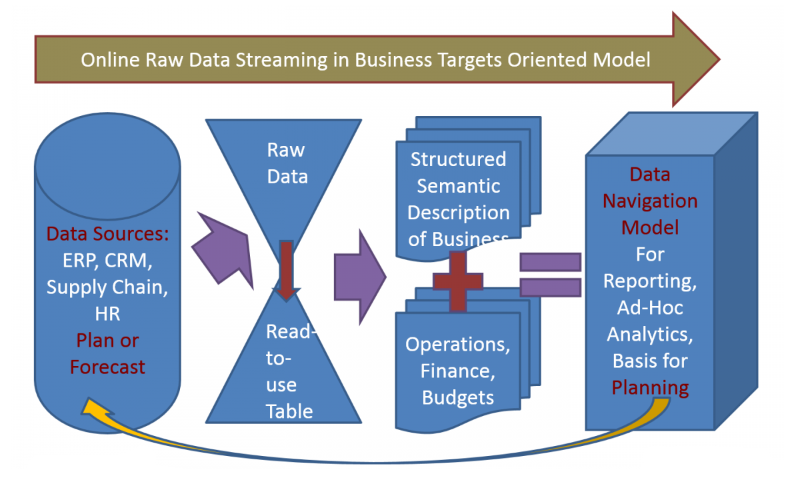

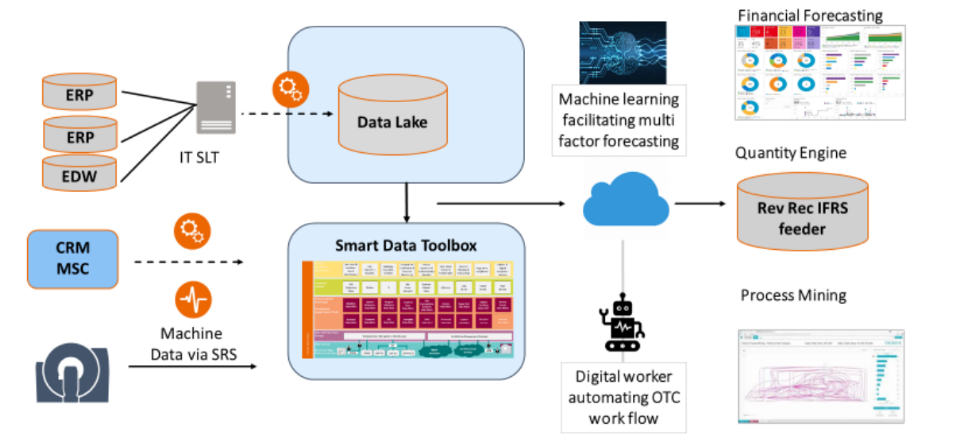

The first step in the FP&A process involves collecting financial and operational data from ERP systems, data warehouses, and other business solutions. In addition, data from outside the enterprise (pertaining to broader demographic, economic, and market data) may be collected. Once all the necessary data is collected, it needs to be consolidated, standardized, and verified. Accurate plans, forecasts, budgets, and analysis all depend on the quality and completeness of the data they use making this step essential. It’s also very time consuming, so businesses are now turning to AI-powered solutions that can automate many of these tasks.

2. Planning and forecasting

The most commonly used financial planning methods include:

Predictive Planning: FP&A professionals create a model on large data sets of past performance. Then this time-series forecasting model is used to predict future performance. Predictive analytics supercharges planning tools, especially when it’s integrated in a single solution and augmented with AI and machine learning.

Driver-Based Planning: Analysts identify a company’s key business drivers (things that are most important to its success) and then create a series of plans that mathematically show how the business drivers would be affected by different variables.

Multi-Scenario Planning: This is the planning method used increasingly by businesses today. In multi-scenario planning, analysts make assumptions about what might happen in the future, anticipating consequences and then creating a plan for responding to each plausible scenario.

Financial and operational plans needed to achieve the business’ main strategic goals are created from the models and forecasts. The strategic plan includes high-level targets like revenue and net income over the short and long term developed by senior management with FP&A input. Collaboration across departments is critical for all types of planning to ensure plans that take all data, variables, and expertise into account. This helps increase both accuracy and engagement. Collaboration brings more validity to plans by helping to build consensus around them.

3. Budgeting

In this step, FP&A professionals estimate the expenses needed to execute the corporate plan based on the revenue from the strategic plan. An expense budget is then allocated to each business unit or function with the revenue and cash flow they are expected to generate. Corporate collaborates with every department and then rolls up the agreed upon budgets into one master budget.

The corporate budget is usually created annually, and updates are made quarterly as financial conditions change. Many businesses have now adopted continuous budgeting cycles that are frequently updated with rolling forecasts and projections to better cope with volatile market conditions. Some organizations have also adopted zero-based budgeting, which avoids bloat and overspending by continually evaluating which expenses are necessary and which are not.

4. Performance Monitoring and Analytics

To advise the business and provide decision support, FP&A teams analyze financial data and monitor performance (sales, expenses, profit, working capital, cash flow, and other KPIs) on an ongoing basis. They answer ad hoc queries and translate numbers into a data story (or narrative) to help decision makers understand a situation and take considerable actions. FP&A analysts generate regular reports and data visualizations to conduct activities like profitability analysis.

Modern Technologies For FP&A

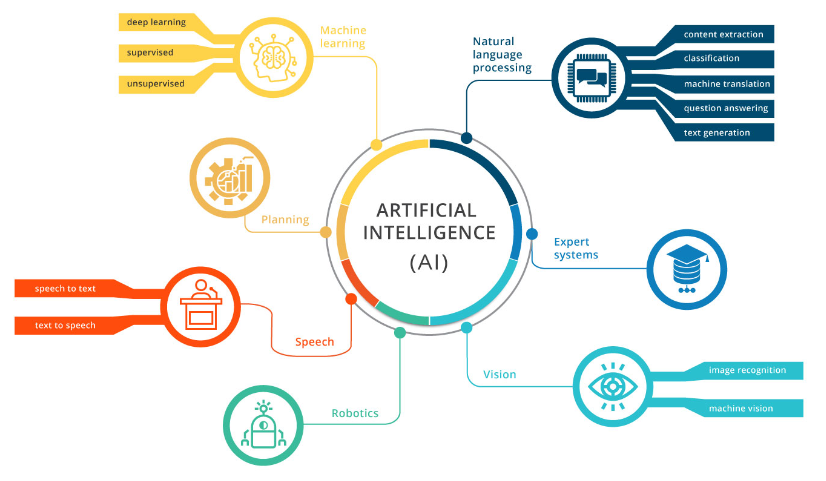

Automation, artificial intelligence, and the cloud are changing the game by making plans, budgets, and forecasts more accurate and financial analytics more powerful. Companies that use these technologies in their FP&A activities have a much better crystal ball than their competitors. It’s an incredible advantage.

Cloud: Traditionally, FP&A software was deployed on premise, but cloud-based solutions offer a lot of opportunity. They can connect to more Big Data sources than their on-premise counterparts, they can be accessed from anywhere, they offer easy collaboration, and they are scalable and cost-effective. Recent advancements in cloud security have also made data more secure, in many cases, than if it were to be stored on premise.

Embedded Collaboration Tools: Built-in collaboration and planning orchestration through discussion and commenting tools (similar to Slack and Teams), automated task scheduling within a calendar, and mobile display across phone, tablet, and digital boardroom can help drive engagement, accuracy, and efficiency in the planning process and FP&A organization.

AI and Machine Learning: Financial planning and analysis tools that are augmented with AI and machine learning are hugely beneficial to FP&A analysts. Not only can they help users analyze more types of Big Data from more sources, but they can also uncover trends, patterns, correlations, and insights that might otherwise go unnoticed. AI and machine learning dramatically improve the accuracy of financial forecasts – and supercharge predictive analytics, self-service reporting, and multi-scenario planning.

Let XBlock Consulting Assist You

XBlock Consulting has an in-house team of talented data scientists, developers, designers, mathematicians, engineers, and creative artists, bringing insight and confidence to corporate decision-making. XBlock will assist you in your needs to building ERP and software systems, and fintech solutions to meet your FP&A growing needs within your business. As businesses become even more competitive and complex, expect FP&A solutions to evolve to meet new challenges: