Vulnerability

For accounting firms’ cyber security is a powerful deterrent. Hackers are increasingly sophisticated, and the growth of cyber incidents is significant. The COVID-19 pandemic and economic downturn has only complicated the issue.

Client Risk

Accounting firms must guarantee the safety of the information that clients entrust to their care. From Social Insurance Numbers to financials, accounting firms hold some of the most important information for individuals and businesses. If firms cannot keep this information protected, the consequences are significant. Accounting firms have a duty to protect this information at all costs.

Financial Risk

The financial consequences of a cyber attack are considerable and it takes awhile for most breaches to be detected, an average of 280 days.

Ease of Hacking

While organized criminal enterprises are at the heart of many cyberattacks, hacking that completely disrupts your firm can be the work of an amateur. With very little training and sophistication, a hacker can disrupt your business and be very costly.

Reputational Loss

If your accounting firm is exposed to an attack, the losses are far more than financial. There is a major reputational risk. Affected customers are likely to talk. Some cases will reach the news media. Recovering some reputational losses can be difficult and as costly as the financial losses incurred due to a cyber attack.

How To Develop An Effective Accounting Firm Data Security Plan

It is critical for accounting firms to have proactive systems in place and be protected from the above risks. Cyber attacks and breaches are the result of avoidable issues and human error, thus educating staff and clients on the risks and best practices can protect everyone involved. Having a data security plan is critical for CPA firms and accounting practitioners. When planning for cyber security, firms should consider all components of accounting technology, including email, servers, cloud solutions, and employees.

Best Practices For A Cyber Security Plan

1. Invest In Practice Management System With A Cyber Security Solution

Bring in the experts who propose solutions to cover everything from patch management to technology auditing which can identify vulnerabilities, and penetration testing, which helps assess where there is exposure. This protects your network perimeter and architecture to ensure security and operability. Having both eyes and firewalls monitoring your firm’s activity can help detect intrusions quickly and reduce risk.

2. Understand The Importance Of Backups

CPA Firms should plan to back up their data, operating systems, and applications, during tax season, when they can’t afford a single glitch. Automated nightly backups protect businesses and data from glitches or strikes. Having files archived offsite using virtualization is an easy way to quickly restore anything that’s been lost in the case of a cyber attack or other issue. Backups protect against cyber attacks and network or technical glitches, natural disasters, or computer theft. Knowing that data is safe and secure creates an immeasurable peace of mind during the stress of a potential cyber security breach.

3. Email Security

When it comes to cyber security and CPA firms, the best option is to message team members and clients within a platform or portal (Cloud based). If email is the only option, consider implementing application security or email-layer protection. In phishing, hackers use your email to attack the firm or the clients.

4. Passwords & Authentication

Password pilfering is a major cause of breaches with accounting firms having strict password policies and secure storage in place. Clients and employees should be informed as to password best practices, like how to create strong passwords that include numbers, special characters and both upper and lowercase letters. Firms should enable multi-factor authentication to protect their company from cyber attacks. Multi-factor authentication typically requires users to submit a known factor, such as a password, and an unknown factor, such as a system-generated passcode, Captcha, or third-party verification application. When combined factors are used, it becomes difficult for hackers to use stolen passwords to access your information systems.

5. Encryption

6. Permission Controls

Assigning permission levels is a simple way to protect data. Each user or employee is only able to access the information that is critical and appropriate for them giving managers the ability to easily lock accounts when an employee is terminated or no longer a need for them to see specific data.

7. Employee Training

Firm owners and accounting practitioners need to ensure their employees are following privacy protocol 100% of the time. Have employees sign a policy agreement and educate employees on risks and protocols when it comes to cyber security.

8. Cyber Security Insurance

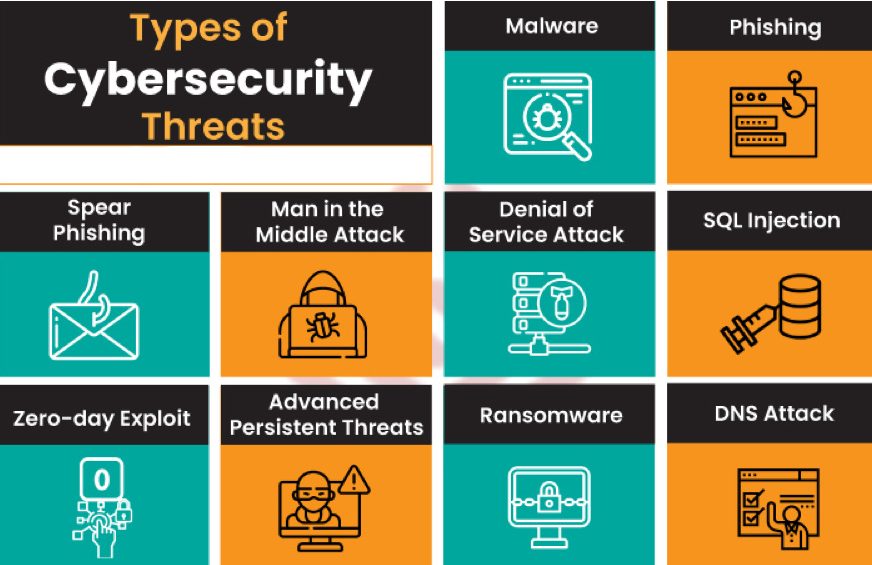

Cyber security insurance will soon be required and can be a lifesaver for CPA firms. Cyber security insurance protects businesses against financial losses caused by cyber incidents, including data breaches and theft, system hacking, ransomware extortion payments and denial of service. Hackers often programmatically look for targets and attack small firms because of certain vulnerabilities, and not set on attacking a specific company.

Become Cyber Secure

Cyber security can be described as the collective methods, technologies, and processes to help protect the confidentiality, integrity, and availability of computer systems, networks and data, against cyber-attacks or unauthorized access. XBlock Outsourcing can help you with your Cyber Security needs. XBlock can provide tools that are available for Small and Medium Enterprise (SMEs) by selecting small chunks for smaller organizations (a concept called Software as a Service).

Currently, there are many unfilled Cyber Security jobs. According to Cyberseek, nearly half of total cyber positions in the United States are vacant. This has caused cyber attacks to spike during the pandemic with increasing intensity. There is a need for new security technologies for development to combat the increasing number and complexity of attacks. Hence, heightening the need for Cyber Security expertise that is in short supply. Many organizations are in need and challenged to build and scale security teams to protect their critical assets. Organizations are being vulnerable to increased attacks on ransomware, phishing, cloud attacks, and IoT breaches, etc.

XBlock Outsourcing’s Cyber Security teams will assist in staffing quickly and flexibly. In addition, add dedicated security specialists on demand 24/7. Secure experienced resources at affordable rates and ensure compliance with the latest security standards and controls.

XBlock Outsourcing offers state of the art offshore IT support and development services. Our team specializes in Enterprise Solutions & Architecture Consultancy, Database Management, Cyber Security and Digital Transformations.

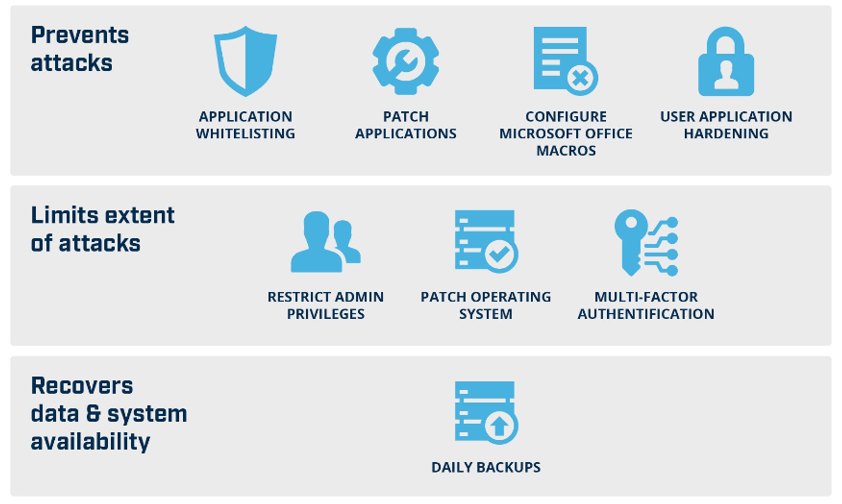

Essential Controls: 10 Priority Areas For Increased Cyber Resilience

Essential 8 Security Controls

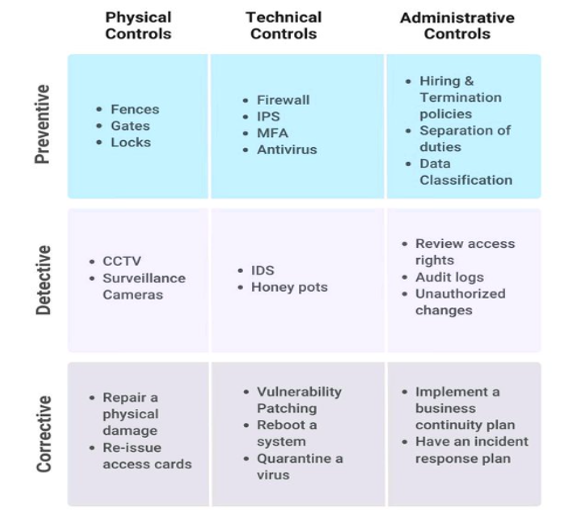

Types Of Cyber Security Controls