XBlock Consulting Will Help Build Modern Finance & Accounting Tools for Your Organization

Fintech refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers. It primarily works by unbundling offerings by such firms and creating new markets for them.

Backed by a team of professionals, XBlock Consulting will assist in the creation of financial technology to improve and automate the delivery and use of financial services. At XBlock, we understand you need to effectively run a business which requires building the right product and delighting your customers by also making money. For most startups, balancing the books, managing expenses, issuing invoices, and chasing late payments just isn’t what they planned for. Our solution is to provide an enterprise data platform that extracts information from the SaaS apps you already use, and automatically delivers it to where it’s needed for finance, accounting, and operations.

Key Takeaways

- Fintech refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers.

- It primarily works by unbundling offerings by such firms and creating new markets for them.

- Companies in the finance industry that use fintech have expanded financial inclusion and use technology to cut down on operational costs.

- Examples of fintech applications include robo-advisors, payment apps, peer-to-peer (P2P) lending apps, investment apps, and crypto apps, among others.

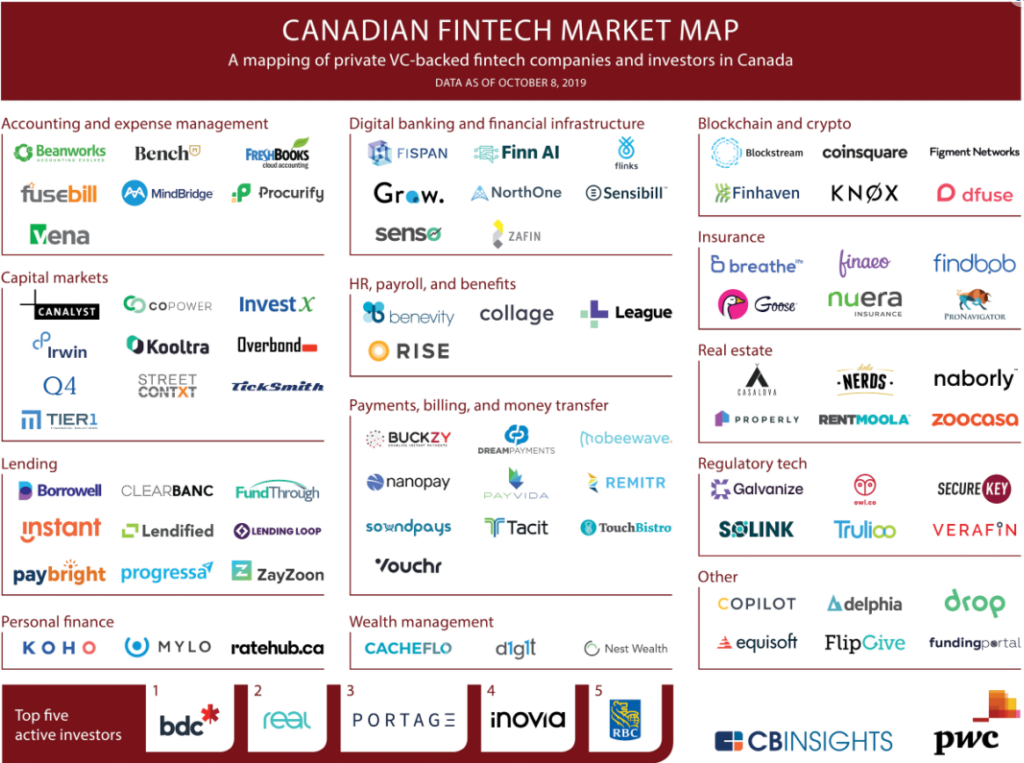

Some of the most active areas of fintech innovation include or revolve around the following areas:

- Cryptocurrency (Bitcoin, Ethereum, etc.), digital tokens (e.g., non-fungible tokens, or NFTs), and digital cash. These often rely on blockchain technology, which is a distributed ledger technology (DLT) that maintains records on a network of computers but has no central ledger. Blockchain also allows for so-called smart contracts, which utilize code to automatically execute contracts between parties such as buyers and sellers.

- Open banking, which is a concept that proposes that all people should have access to bank data to build applications that create a connected network of financial institutions and third-party providers. An example is the all-in-one money management tool Mint.

- Insurtech, which seeks to use technology to simplify and streamline the insurance industry.

- Regtech, which seeks to help financial service firms meet industry compliance rules, especially those covering Anti-Money Laundering and Know Your Customer protocols that fight fraud.

- Robo-advisors, such as Betterment, utilize algorithms to automate investment advice to lower its cost and increase accessibility. This is one of the most common areas where fintech is known and used.

- Unbanked/underbanked services that seek to serve disadvantaged or low-income individuals who are ignored or underserved by traditional banks or mainstream financial services companies. These applications promote financial inclusion.

- Cybersecurity. Given the proliferation of cybercrime and the decentralized storage of data, cybersecurity and fintech are intertwined.

- AI chatbots, which rose to popularity in 2022, are another example of fintech’s rising presence in day-to-day usage.

(Source: Investopedia.com)

Fintech Users

- Business-to-business (B2B) for banks

- Clients of B2B banks

- Business-to-consumer (B2C) for small businesses

- Consumers

Trends toward mobile banking, increased information, data, more accurate analytics, and decentralization of access will create opportunities for all four groups to interact in unprecedented ways.